Major Forrester Wave Methodology Changes (June 2024)

Today Forrester announced an update to their Wave methodology with some significant changes. Here’s everything you need to know:

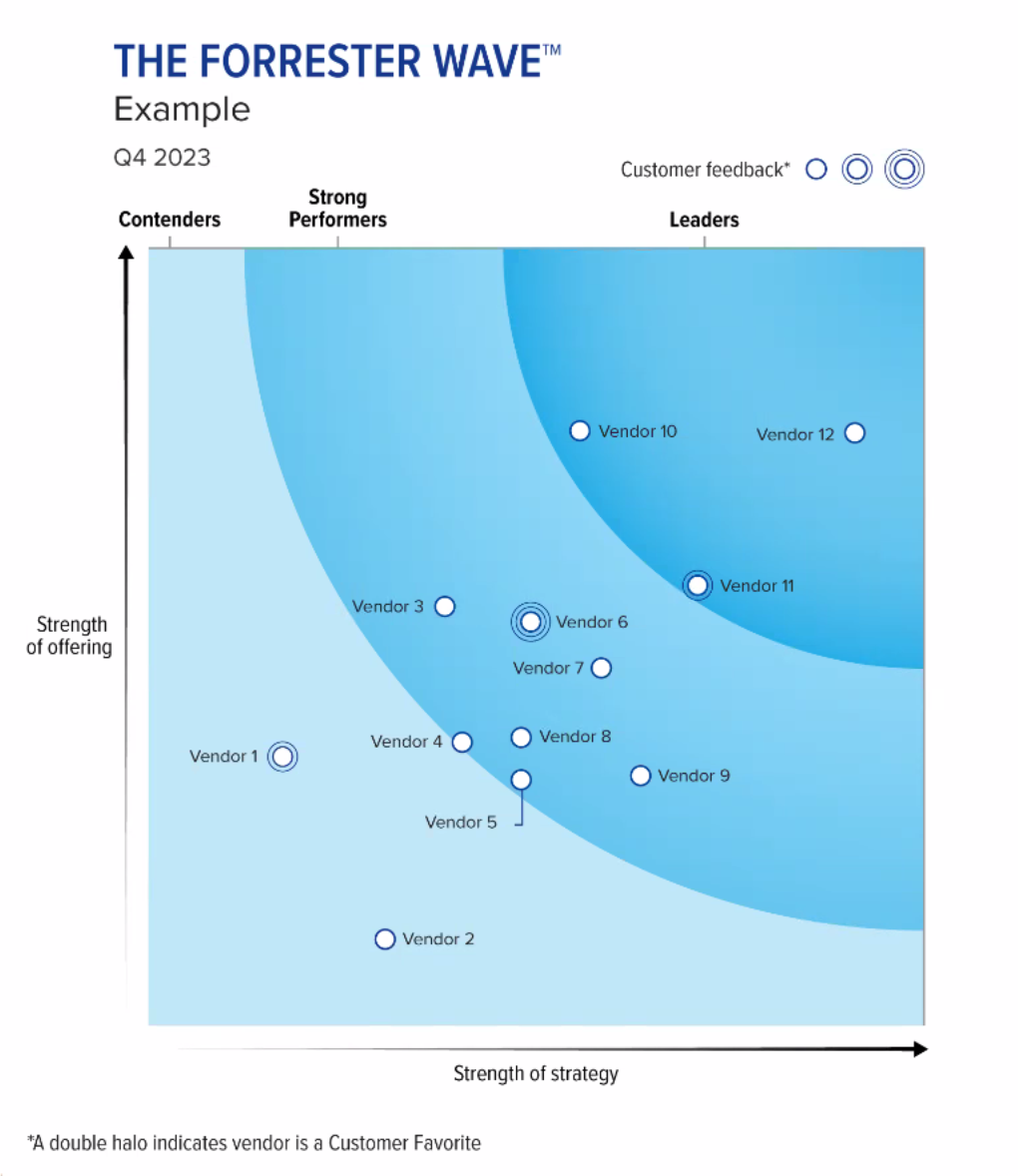

Forrester-provided mockup of the new Wave Graphic

Goodbye to “Challenger” With this update Forrester will eliminate the “Challenger category - vendors will be ranked Contender, Strong Performer, or Leader only. Forrester says in their vendor guide that Challengers has generally been fewer than 10% of vendors and they expect these to be redistributed into the Leaders and Contenders bands, with Strong Performer staying roughly the same.

My take: it has been interesting to watch how many no-Leader waves have been published this year, and I have heard from several sources this has been a source of frustration to Analysts - hopefully the new methodology will help address this.

Forrester gets even more Startup Friendly - Market Presence goes away in the new version - all vendors will be represented as the same dot size, but those with especially strong Customer Feedback will earn a single or double halo highlight emphasizing their customer feedback strength.

My take: Forrester’s Wave methodology was already the more startup friendly of the big two, but removing Market Presence in favor of customer feedback makes these evaluations even more open to new companies performing well.

A New Leader in Reference Quality. Along with this, Forrester will make live customer interviews standard, and do away with survey reference feedback.

My take: The decision to do away with survey reference data collection is a great one - that methodology left a ton of reference nuance on the table, not to mention creating security risks for participating vendors. Reference richness will now be a significant differentiator versus the Gartner Magic Quadrant, which uses the easily-gamed Gartner Peer Insights for MQ reference data.

Gray Dots Get… Much Grayer. Forrester is significantly changing how they handle non-participating vendors in Waves going forward. The graphic will no longer include gray dots to indicate non-participation; instead the extent to which the vendor participated will be noted in the vendor write-ups. Only vendors who participate in everything (Questionnaire, briefing, demo, references) will be eligible to participate in factual corrections.

My take: It’s a cynical one - Forrester has been struggling with increasing vendor non-participation, and this change will functionally hide that from the headline graphics (and as a result, from buyers). I’m not a fan.

A New Writeup Format. Based on the example provided, new Vendor Profiles will start with a sentence of the company’s offering in the space, plus a sentence of its recent innovations and news. The body of the writeup will include paragraphs dedicated to “Strategy Analysis,” “Capabilities Analysis” and “Customer Feedback”. Writeups will end with a sentence of “Forrester’s Take” - typically who in the market the company is a good fit for.

My take: This is a clear and logical format. Time to go update my Mad-lib exercise!

A New Interactive Experience. Forrester Clients will now have a “find a vendor offering” wizard that allows them to create their own shortlists based on the underlying wave data and their needs.

My take: Forrester has long said publicly that they believe buyers use their macro-enabled spreadsheets to customize the reports to their own needs and “create their own graphics.” Vendors have long known that the released graphic is the only graphic that matters. Making the customizable version more accessible is great, but it’s still gated.

—-

Overall - I think these are largely positive changes. Although Forrester is positioning the “New Interactive Experience” as the headline of this release, I think it is likely to be the least consequential change of this set, as it will be gated and only apply to Forrester subscribers who take the time to reprioritize vendor rankings. In my experience, buyers almost never do this and instead rely on the graphic and rankings as published.

It is smart repositioning on Forrester’s part to double down on live customer references as this was once Forrester’s strength, especially given Gartner’s use of Gartner Peer Insights as the only MQ reference source. As a lifelong CX person, I love the focus on Customer Feedback over size, and I think my startup clients will as well.

Upward (and to the right!)

-Elena